|

| US total debt to GDP - the aim will be to inflate this debt away |

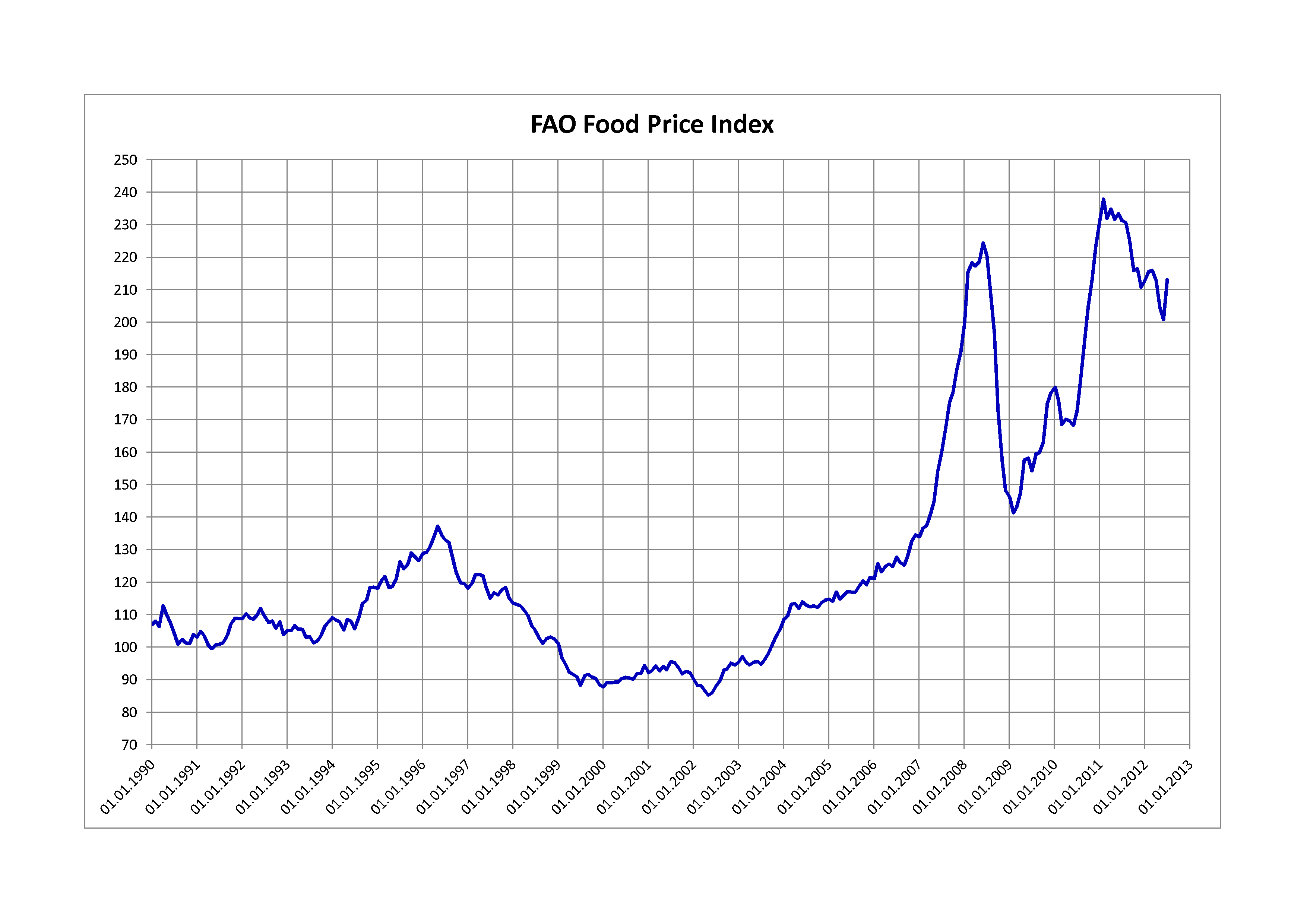

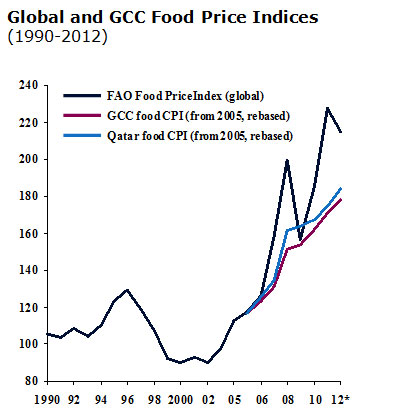

How could this debt possibly be serviced? The answer is, it cannot be, at least in any rational sense of the word. We believe that governments will do what they have always done, which is to lower debt by printing additional money - probably through Quantitative Easing (QE) or some similar method - which will lower the real (as opposed to nominal value) of this debt. We would argue therefore that looking at farmland as a hedge against inflation makes a lot of sense.

As a "hard asset", and investment in farm land in land will will not only provide investors this inflation hedge, but also offer a steady stream of good dividend income and offering excellent upside potential for capital gains due to the ongoing agricultural "super cycle" as coined by noted farmland and commodities investor Jim Rogers.

If you are interested to learn more about our unique, high dividend African farmland and European farmland investments, please contact us at info@greenworldbvi.com.